AI AND THE FUTURE OF IN-PERSON SHOPPING

A look at how artificial intelligence is driving tangible advances in retail

AI AND THE FUTURE

OF IN PERSON SHOPPING

A look at how artificial intelligence is driving tangible advances in retail

Retail is undergoing a transformation that will alter the everyday shopping experience for years to come. The consumer goods market, flush with product options and purchasing channels in nearly every category, is revealing many retailers’ weaknesses while rewarding those that adopt AI and machine learning to quickly adapt to new realities.

Technological advances hit the online world first. In the mid-2000s, Amazon’s growth trajectory steepened and drove traditional retailers to follow suit, eventually adding their own web and mobile channels with comparable delivery options and return policies. This later spawned a new era of digital-native competitors and later direct-to-consumer brands that would make up a $700 billion ecommerce industry by 2020.

As Amazon reaped the benefits of adopting “futuristic” technology first, traditional retailers—those still primarily focused on the brick-and-mortar channel—saw their market share challenged by new, digital competitors, especially of customers in the lucrative 25-34 age range. As many brands fought back by investing heavily in their own online shopping experience, the physical store format went largely unchanged, marked by inconveniences like long wait times and limited access to certain products.

Now the brick-and-mortar side of retail is at a crossroads. Brands must adapt to an increasingly digital-driven economy or continue on the same path and hope customers remain loyal. Those that choose the adaption path have a wealth of technology to choose from: advanced machine learning techniques, highly reliable data infrastructure, and hardware that can be deployed affordably across thousands of retail locations.

THE STATE OF

RETAIL TODAY

Over the past decade, the retail sector experienced reliable, positive indicators. Consumer spending since the Great Recession steadily rose in the United States and helped keep per capita GDP on a similar trend line, with both growing between 1% and 3% year over year.

Retail sales dipped dramatically after the onset of the Covid-19 pandemic but rebounded by September, leaving much room for speculation about what long-term recovery looks like. Consumer habits shifted toward online purchases, a pattern that many expect to continue. As the U.S. looks ahead to an unpredictable economic path, shopping behavior may continue to fluctuate.

The pandemic exacerbates brick-and-mortar challenges

Unstable demand (and sometimes supply) has created a competitive environment among retailers heavily invested in brick-and-mortar. Online retail was on the rise well before Covid kept millions of shoppers home, but now ecommerce sales have accelerated, pushing brands to to make their physical spaces more safe and enjoyable for customers.

Some retailers were able to lean on existing logistics infrastructure and cash reserves, quickly ramping up online order fulfillment and services curbside pickup. Many began implementing technology that better integrates their digital channels and physical ones, though most stores collect little actionable data from day-to-day customer interactions.

Other retailers struggled, closing or filing for bankruptcy in quick succession. In a sign of the times, the ones that fared the worst were those that failed to build the basic infrastructure to successfully bridge their digital and physical worlds before it became essential for survival.

CPG and grocery still going strong

Predictably, consumers kept buying food and packaged goods throughout the economic turmoil of 2020. While some shifted to online ordering services like Instacart and Amazon Prime, many still shopped in person. Big-box retailers thrived as customers looked to one-stop shopping options, while smaller stores struggled with unpredictable demand and rapidly changing local regulations. But as with the broader retail sector, reports have indicated that convenience store foot traffic has already rebounded substantially.

As retail rebounds, those that continue to perform well do so because of their ability to understand customers needs. They’ll adopt technology that allows them to accurately track inventory and understand shopping behavior, then stock their shelves and allocate employee time accordingly.

AI BREAKTHROUGHS AND

HOW THEY IMPACT RETAIL

Artificial intelligence is a broad field of study with the potential to impact nearly every corner of every industry. While some use cases have been disproportionately hyped in spite of being years away from commercial viability, breakthroughs in AI and machine learning have had a very real impact on the retail world. Companies are deploying AI to transform both the physical shopping experience and the analytics used for decision-making.

Advanced machine learning algorithms

Machine: learning has revolutionized the way retailers stock, manage, and promote their online and physical storefronts. In addition to the classification, regression, and clustering algorithms commonly used for process automation and predictive analytics, advances in deep learning have made more complex analysis of larger data sets possible. These techniques allow retailers to understand more about their customers, implementing features like:

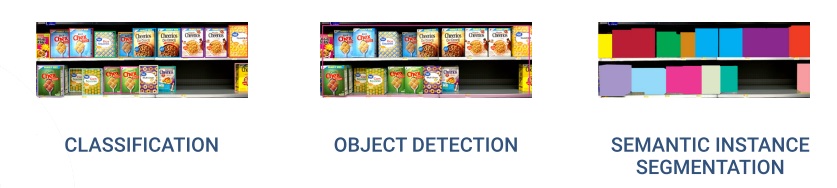

Computer vision

Computer vision is a field of AI focused on how machines can accurately identify and classify objects and their surroundings to effectively “see” the real world. Advances in both software and hardware has made computer vision a powerful way of visualizing what happens inside a store, including which products customers interact with and how they navigate the physical space. Computer vision scholars have increasingly embraced deep learning to further real-world applications of this technology.

Some brands also use computer vision to serve consumers at home. Before committing to a purchase, shoppers can use an app with augmented reality (AR) to visualize a product (like a Pelaton bike) in their living space. Companies like Farfetch let people snap a photo of styles they see in real life to visually search their online inventory for a similar product.

Edge computing allows data to be processed and analyzed where it is collected, as opposed to in the cloud or in a private data center. This serverless computing power means transactions can be recorded accurately, behavior can be interpreted instantly, and private data can remain on premise and fully secure. It also lowers infrastructure costs by using less server capacity to run queries or maintenance jobs.

Another fascinating application of edge computing in retail helps solve the U.S.’s broadband coverage gaps, by opening up the possibility of AI stores in places with poor internet connections. The most recent FCC broadband report shows over 20% of rural areas lack access to basic fixed broadband services, and at least 37% lack a minimum of 100 Mpbs (which is around the minimum speed needed for reliable commercial use). By processing data on site at a lower cost, retailers can open stores in underserved communities across the country.

NEW OPPORTUNITIES

FOR BRICK AND MORTAR

Macroeconomic and consumer trends, pandemic forces, and the advancement of technology have created an environment ripe for innovation for retailers. Of the many sectors experimenting with AI, one of the most promising applications exists in grocery and consumer packaged goods (CPG). Retailers in these industries benefit from selling products that require no installation, can be easily transported out of the store, and have a short decision making process to complete transactions.

Early movers have advantages, and the retailers that make changes now are likely to see improved market share and sales for years to come. Companies like AiFi are driving this evolution of retail for brands of every size, bridging the physical location with advanced technology to address the classic challenges of operating brick-and-mortar stores.

Decode consumer behavior with computer vision

Traditionally, most data on consumer behavior and store performance is collected via survey, basic inventory tracking, and historical purchase data. This has given online retailers a big upper hand— they can track massive volumes of data on every interaction customers have with their site or application, making constant adjustments to the product mix, recommendations, and promotional offers.

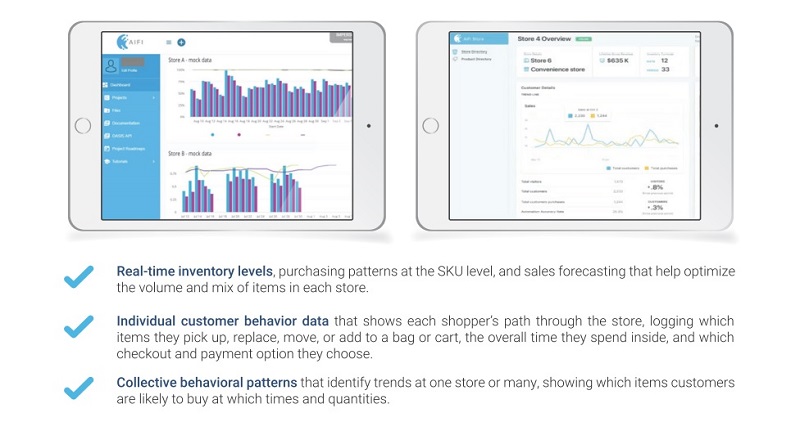

Now retailers with brick-and-mortar stores can use computer vision to collect the same type of data in physical spaces. This includes data on:

Open new physical locations

or reinvent old ones

The overall share of retail sales belongs handedly to brick-and-mortar, trending toward an estimated $4.5 trillion value by 2022. The answer isn’t to replace physical stores with online experiences—instead, retailers are finding ways to enhance both channels through improvements to each.

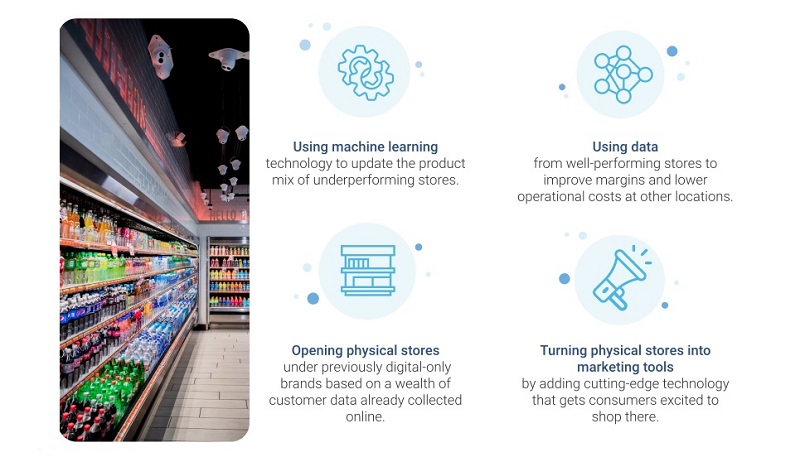

Brands are finding interesting ways to increase the value of their physical stores:

Eliminate checkout for safer,

more enjoyable shopping

Now more than ever, retailers are looking toward completely contactless shopping. Computer vision allows people to purchase goods without checking out with a cashier or waiting in line while intelligent analytics optimize traffic patterns.

AI-powered stores go far beyond the self-checkout kiosks common at grocery, drug, and convenience stores today. Retailers can partner with companies like AiFi to design the right implementation for each store, letting customers put items in a bag or cart and walk out of the store without ever touching a scanning device or interacting with a cashier.

As consumers realize they can shop in person without wasting time or subjecting themselves to unnecessary risk, brands that eliminate the typical frustrations of checkout will gain market share from those that fail to adapt.

Eliminate product shrinkage

Shrinkage, or the discrepancy between expected retail value and actual retail value of inventory, presents a significant risk to the retail bottom line. Driven primarily by loss of stock, most shrinkage happens when items are stolen, damaged, or wrongly tallied at checkout. A small percentage of shrinkage can also be attributed to factors like unexpected markdowns and regulatory issues.

Shrinkage costs large retailers millions each year, both in direct inventory losses and in labor cost from manually monitoring and counting large volumes of items. AI can not only automate the inventory tracking required to lower this cost, it can also be used to monitor in-store behavior and prevent theft, fraud, and cashier error.

Capture revenue in unexpected places

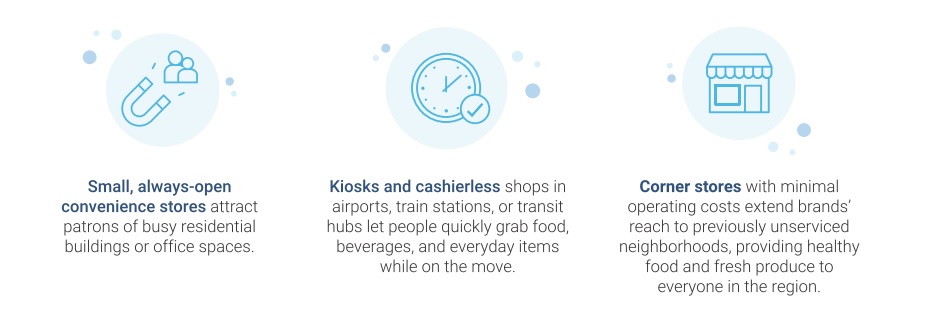

The increase in actionable data and the operational efficiency that comes from AI gives retailers plenty of options for new revenue streams. Retailers are experimenting with smaller grocery stores formats, kiosks, and convenience stores in non-retail facilities to capture more revenue from people on the go.

When brands are able to collect and analyze data on physical customer behavior and traffic patterns, they can identify the right places for new shopping experiences:

THE ANATOMY OF AN

AI ENABLED STORE

There’s no one blueprint for retailers looking to deploy artificial intelligence in existing or new stores. That’s why we built AiFi solutions to be flexible, giving each brand the opportunity to create their own unique “store of the future”. The successful autonomous store both excites customers and provides a tangible return on the company’s investment in AI.

The store of the future

A bird’s eye view of how AiFi transforms retail locations

THE ROI OF AI POWERED

STORES

In an environment where every decision counts, retailers want to know they’ll see a return on their investment in AI and machine learning. Here’s how brands increase sales, lower operational costs, and protect themselves from future risk and competition as intelligent retail becomes more mainstream:

1. AI-powered shopping experiences keep customers coming back and buying more. Inventory optimization helps each location sell more.

2. It costs less to operate checkout-free, optimized stores. Each store can stay open longer without adding overhead, reduce loss from stockouts and shrinkage, and automate tedious inventory planning and forecasting.

3. Contactless stores with low wait times mean safer shopping experiences for everyone. Customers have fewer close interactions with staff, and employees are free to move around the store to help shoppers without crowding high-traffic areas.

AIFI MAKES AI RETAIL POSSIBLE

AiFi’s OASIS Platform uses machine learning, computer vision, and sensor fusion to enable autonomous stores at any location. Designed with flexibility and scalability in mind, it seamlessly handles all retail needs from providing a seamless shopping experience to back store analytics to optimize profitability and productivity.

Transform an Existing Store

with AiFi’s Retail Platform

Install smart, computer vision systems in one of your ores to start capturing data instantly on the AiFi atform, then switch to fully autonomous checkout henever you’re ready.

Create a New,

AI-Powered Location

Plan one or more new store openings with support from the AiFi team. We’ll help you build a shopping experience that cultivates growth, innovation, and customer loyalty.

Deploy a Ready-to-Go

NanoStore

Drop a fully operational autonomous store into any commercial space. The AiFi NanoStore requires no staff, can stay open 24 hours a day, and is customizable to fit your brand.